Small Business Accountant Vancouver Things To Know Before You Buy

Wiki Article

Some Ideas on Tax Consultant Vancouver You Need To Know

Table of ContentsHow Virtual Cfo In Vancouver can Save You Time, Stress, and Money.What Does Tax Consultant Vancouver Mean?Not known Incorrect Statements About Cfo Company Vancouver Not known Facts About Pivot Advantage Accounting And Advisory Inc. In VancouverOur Vancouver Tax Accounting Company IdeasTop Guidelines Of Cfo Company Vancouver

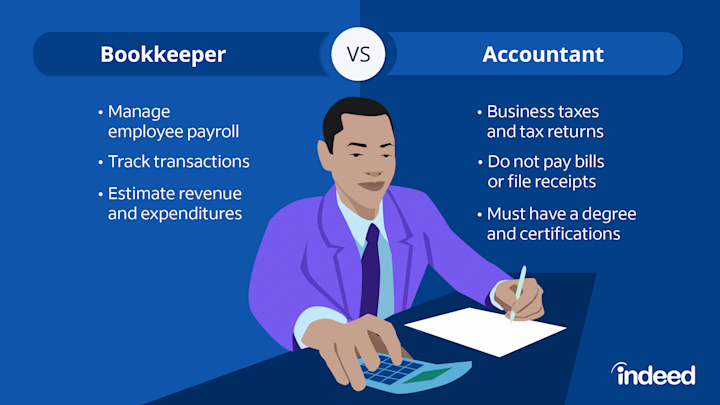

Right here are some benefits to hiring an accounting professional over an accountant: An accounting professional can provide you a detailed view of your business's economic state, together with strategies and referrals for making financial decisions. At the same time, accountants are only accountable for taping economic transactions. Accounting professionals are called for to complete more schooling, accreditations as well as work experience than bookkeepers.

It can be difficult to gauge the ideal time to employ an audit expert or bookkeeper or to identify if you require one in all. While several tiny companies work with an accounting professional as a specialist, you have a number of options for dealing with economic jobs. For instance, some small company owners do their very own accounting on software program their accountant recommends or uses, giving it to the accountant on an once a week, monthly or quarterly basis for action.

It might take some background research to discover a suitable accountant since, unlike accountants, they are not required to hold an expert qualification. A strong endorsement from a trusted coworker or years of experience are essential aspects when employing a bookkeeper.

The Single Strategy To Use For Virtual Cfo In Vancouver

For local business, proficient cash management is a critical element of survival and also development, so it's smart to collaborate with a monetary specialist from the beginning. If you favor to go it alone, think about beginning with audit software and keeping your books meticulously as much as day. By doing this, must you require to work with a professional down the line, they will have exposure into the full financial history of your service.

Some resource meetings were performed for a previous variation of this write-up.

Everything about Outsourced Cfo Services

When it comes to the ins as well as outs of tax obligations, audit and also money, nonetheless, it never ever hurts to have a knowledgeable expert to look to for advice. A growing variety of accounting professionals are likewise taking treatment of points such as capital forecasts, invoicing and also HR. Inevitably, a lot of them are tackling CFO-like roles.Local business proprietors can expect their accountants to aid with: Picking business framework that's right for you is very important. It influences exactly how much you pay in tax obligations, the paperwork you need to submit and also your personal responsibility. If you're seeking to transform to a different business framework, it could cause tax obligation consequences as well as other difficulties.

Even firms that are the exact same size as well as industry pay really different quantities for accounting. These expenses do not convert into cash, they are necessary check my site for running your service.

Everything about Virtual Cfo In Vancouver

The average price of audit services for little business varies for each unique situation. The ordinary monthly bookkeeping fees for a small service will climb as you include more services as well as the tasks obtain more challenging.You can tape-record transactions and also procedure pay-roll making use of online software application. You go into quantities into the software program, and also the program calculates overalls for you. click here for info In many cases, pay-roll software application for accountants enables your accounting professional to supply payroll processing for you at extremely little extra expense. Software application solutions come in all shapes as well as sizes.

The smart Trick of Vancouver Accounting Firm That Nobody is Talking About

If you're a new organization proprietor, do not neglect to factor accountancy expenses right into your budget. Management prices and also accountant fees aren't the only bookkeeping expenses.Your time is also useful and also must be considered when looking at audit prices. The time spent on accountancy jobs does not produce profit.

This is not meant as lawful suggestions; to learn more, please click here..

Getting My Tax Accountant In Vancouver, Bc To Work

Report this wiki page